AI in Credit Risk Assessment: How Machine Learning is Transforming Risk Modeling

The financial industry is undergoing some changes with the integration of AI in credit risk assessment. Traditionally, lenders relied on manual evaluations and rule-based credit risk modeling to determine borrower eligibility. However, these methods often struggle with inefficiencies, biases, and limited data analysis capabilities.

Machine learning credit risk models are transforming the way financial institutions assess risk, enabling more accurate, data-driven decision-making. By analyzing vast amounts of structured and unstructured data, AI enhances credit risk model segmentation, helping lenders differentiate between high-risk and low-risk borrowers.

This shift not only enhances loan approvals but also minimizes defaults, making financial services more accessible. In this article, we’ll explore how AI-driven models enhance credit risk assessment, the types of machine learning models used, and the future of AI in credit risk modeling.

What is AI in Credit Risk Assessment?

AI in credit risk assessment refers to the application of machine learning algorithms to evaluate the likelihood of a borrower defaulting on a loan. Unlike traditional credit scoring models that rely on historical financial data and rigid rules, AI models dynamically analyze diverse datasets, including transaction history, behavioral patterns, and alternative credit sources.

Machine learning credit risk models continuously learn and adapt, identifying subtle risk indicators that traditional methods might overlook. For example, an AI-driven model can assess a borrower’s spending habits, income stability, and even social media activity to predict creditworthiness more accurately. This predictive capability enables financial institutions to make more informed lending decisions while reducing the risk of defaults.

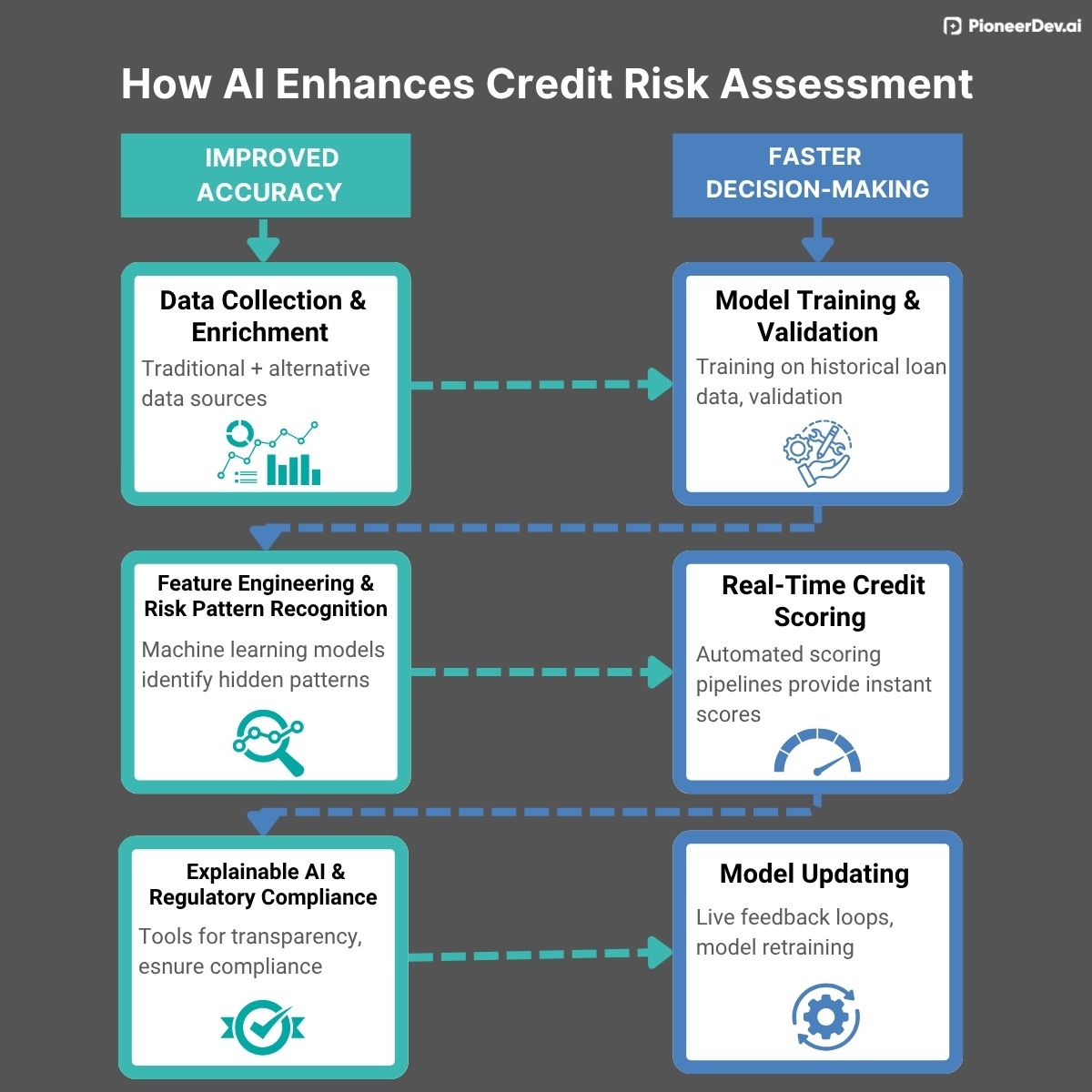

How AI Enhances Credit Risk Modeling

Improved Accuracy

AI-powered credit risk modeling analyzes vast datasets to detect hidden risk patterns, improving the precision of risk assessment. These models leverage alternative data sources, such as real-time financial transactions, to build a more comprehensive risk profile.

Faster Decision-Making

AI automates credit assessments, significantly reducing loan approval times. By processing large volumes of data instantly, lenders can make quicker, more reliable lending decisions, enhancing customer experience.

Reduced Bias & Better Explainability

AI models are increasingly designed to be interpretable, addressing concerns about algorithmic bias. Explainable AI (XAI) ensures transparency, allowing lenders to understand and justify their credit decisions.

Example: AI-Driven Loan Approvals

A leading bank implemented AI in credit risk assessment, reducing loan default rates by 15% while accelerating approval processes. The model’s ability to analyze real-time financial behavior allowed for a more precise evaluation of borrower risk.

Machine Learning Credit Risk Models: Types and Benefits

Traditional vs. AI-Driven Models

Traditional credit risk models rely on predefined rules and historical data, whereas AI-driven models adapt dynamically to changing risk landscapes.

Types of Machine Learning Models Used:

- Logistic Regression: A baseline model often used for credit scoring.

- Decision Trees & Random Forests: Identify complex patterns in borrower behavior.

- Neural Networks: Utilize deep learning for advanced risk predictions.

Business Impact

These AI models help financial institutions reduce loan defaults, optimize lending strategies, and improve overall financial stability.

Credit Risk Model Segmentation: Why It Matters

AI-driven credit risk model segmentation enables lenders to categorize borrowers into precise risk groups, leading to better lending decisions.

AI-Powered Segmentation Examples:

- Differentiating between new vs. existing customers.

- Identifying high-risk vs. low-risk borrowers using real-time data analysis.

Case Study: AI-Driven Lending Efficiency

A fintech company utilized AI for credit risk model segmentation, leading to a 20% increase in loan approvals while reducing non-performing loans.

Future of AI in Credit Risk Assessment

Predictions for AI Adoption

AI adoption in financial risk management is expected to grow significantly, with AI-driven credit assessments becoming a standard practice.

Emerging Trends:

- Explainable AI (XAI): Enhancing transparency in AI-driven credit decisions.

- Real-Time Credit Scoring: Using live financial data for instant credit risk assessment.

- AI-Powered Fraud Detection: Identifying fraudulent credit applications more effectively.

Preparing for AI Integration in Lending

Financial institutions must invest in AI capabilities, ensure regulatory compliance, and train staff to leverage AI-driven insights effectively.

Conclusion

AI in credit risk assessment is transforming the financial sector, enabling faster, more accurate, and fairer lending decisions. Machine learning credit risk models help lenders analyze borrower behavior, automate risk evaluations, and optimize credit risk model segmentation for better financial stability.

As AI continues to advance, businesses must adapt to emerging trends like real-time credit scoring and AI-powered fraud detection. By integrating AI-driven solutions, financial institutions can enhance risk management, improve customer experiences, and maintain a competitive edge in the evolving financial landscape.

As AI continues to evolve, staying ahead means embracing innovations like real-time credit scoring and AI-powered fraud detection. At Pioneer Dev AI, we help businesses navigate these advancements by providing AI solutions tailored to enhance risk management, streamline operations, and create better financial outcomes. Ready to explore how AI can work for you?